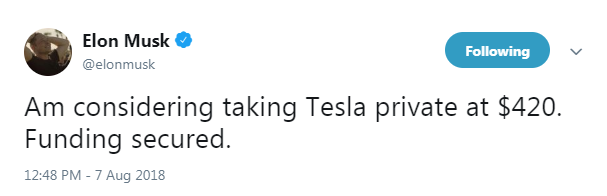

Tesla’s story thus far has been nothing short of a roller coaster ride. The company’s eccentric CEO has made newsworthy appearances quite a few times. One such moment caught the public’s attention a year ago when Elon Musk tweeted that he had secured enough funds to take the company private at $420/share. The stock closed at a good $341.9/share the previous day. The eccentric CEO’s claim was taken as a surprise since the speculations about Tesla’s current price being overvalued have grown in the years after Tesla’s Initial Public Offering (IPO)

There were certain kinds of people who would bet against Tesla that day, in these ever growing speculations about Tesla’s stock not representing the true value of the company. These are the people whom we know as Short sellers. Short sellers borrow shares of a stock and sell it at the current market price in hopes that the price will decrease before they have to return the borrowed shares. In the event of a steep price decline, they make a handsome profit since they sold the borrowed stock at a higher price and now need to buy back the shares at a lower price in order to return those borrowed shares to brokers. Short Sellers lost around $1.3 billion on the day of Elon’s infamous tweet about taking the company private, since Tesla’s stock rose 11% in the aftermath.

In an uncertain state of affairs, mathematics and data can help us estimate the intrinsic value of Tesla. Valuation analysis offers interesting insights on Elon Musk’s claim to take the company private at $420/share. With some degree of certainty, it can also reveal ways to improve Tesla’s valuation.

Understanding Valuation:

In a world with stock market and multiple stakeholders, a financial metric is needed to allocate the share of each stakeholder in the company. At a nascent stage, if 3 investors bootstrapped and pooled in $10,000 each for a start-up, the value of the company would be $30,000 and the share of each investor would be 33.3% each. In a more complicated scenario such as an Initial Public Offering, where a company sells a specific number of shares to the public, the valuation can be determined by the supply and demand of shares. If more people are willing to purchase certain shares of the company, the value of the shares would increase if the supply is kept constant. Other means to value a company is to compare its net income with the net income per share price of a similar company, and use simple ratio and proportion analysis to estimate the share price of the company. In Tesla’s case, since around 80% of Tesla’s business is automotive, it can be compared with General Motors, Ford, Toyota or NIO.

Valuing Tesla is hard. It is not an early stage startup with bootstrapped capital, nor does it generate positive net income for comparable metrics. An elaborate metric is thus needed.

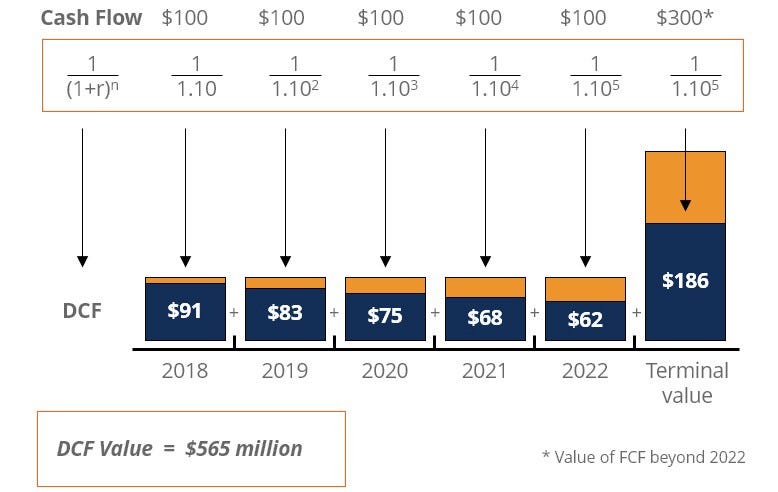

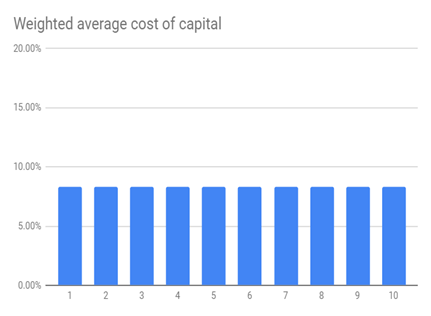

A rather sophisticated metric for valuation is Discounted Cash Flow analysis. Projected future cash flows of the company are computed and discounted using Cost of Capital to estimate the Net Present Value. This Net Present Value is divided by the total number of shares to calculate price/share.

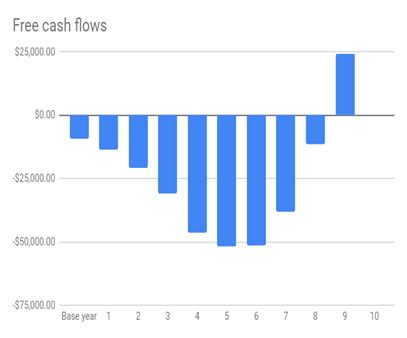

To understand valuation, let’s understand the chart below: Free Cash flow in the present (2018) is projected into the future and discounted using a discount rate also known as Cost of Capital. In this example, a discount rate of 10% is used.

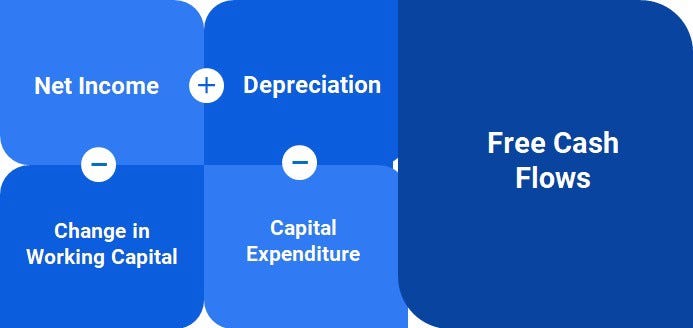

Free cash flows are used by investors to understand whether a company will have enough cash, after setting aside operations and capital expenses, to provide investors with dividends. Cost of capital can be understood as the opportunity cost of investing. An estimate of the free cash flow necessitates looking at four major drivers and projecting them into the future.

Net Income:

To project Tesla’s Net income into the future, Tesla’s historic growth rate and operating margins were studied. Tesla’s revenue grew at an average rate of around 70% in the past. The Automotive industry grew at an average rate of around 44% in the last 5 years. Incorporating these two factors, a super normal growth rate of 30% in the first 5 years and a terminal growth rate of 3% at the end of 10 years was assumed. Linear interpolation was used to get revenues from years 5 -10.

Tesla’s operating margin (as of September 2018) sits at -8%, which lags behind the industry average of 4% and a maximum of around 15%. A very ambitious target of reaching the 80th percentile in the automotive industry was assumed for Tesla in the next 10 years. To reach this highly ambitious target, Tesla would have to be as operationally efficient as BMW and Porsche.

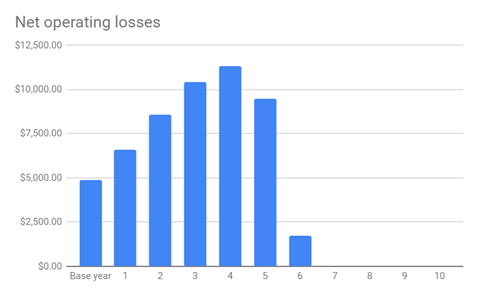

Net Income (after tax) & Net Operating Losses:

Being a proponent of clean and renewable energy, Tesla enjoys a level of tax freedom from the government. These losses are carried forward until Tesla’s net income becomes positive. This means Tesla would not have to worry about paying taxes until year 7. After year 6, they would pay taxes at a renewed rate of 21%.

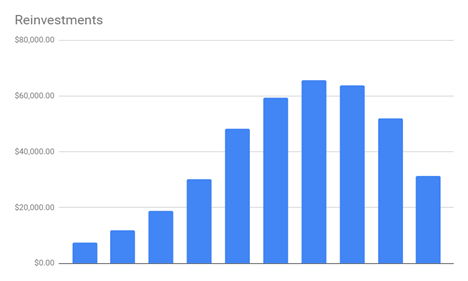

Re-investments:

Re-investments’ forecast was based on working capital turnover ratio. Since the global auto industry is capital intensive, the industry-wide Sales-to-Capital average is around 1.5. Considering Tesla’s Giga-factory and solar city investments payoff in the future, an ambitious but plausible value of $2 in revenue generated per dollar of capital investment was used for the next 10 years of Tesla’s journey.

Free Cash flows:

Cost of Capital:

There are two risk dimensions for Tesla. One of them is the operating risk which is reflected in Cost of Capital and it is estimated to be 8.3%, with 86% contribution from Equity and 14% from debt. The second dimension of risk extends to risk of failure which has been exacerbated by the huge debt that Tesla owes.

The final valuation of Tesla (as of September 2018) is an expected number: $172/share. This is 42% lower than the actual stock value (as of September 2018) and 60% lower than Musk’s claim in his tweet. In light of the current analysis, Musk’s claim can be interpreted as a group of investors paying 144% more than the fair value to buy Tesla.

Why would anyone be interested in this deal which does not sound lucrative at all? Just like a customer is willing to pay a price premium for a luxury product, investors might be willing to pay a price premium for Tesla in order to ripen the exponential benefits later on. Shareholders are also banking on Elon Musk being an innovator and Tesla being a futuristic company. Imagine if you would have invested $100 on the day of Tesla’s IPO, your current rate of return would have been a staggering 1500%. Shareholders and investors are hoping to see the same trend carry forward in the future.

Turning MUSK’s claim into reality:

Currently overvalued, can Tesla still reach a value of $400/share? Yes, it is going to be a steep climb for Tesla and Musk. Let’s see how the goal of $420 could be possible.

- Revenues:

Tesla’s revenue would have to reach $250 B from a current value of $25B. With an average price of $63,000 per car and equal sale percentage of each model, this target translates to selling around 4.2M cars (by year 2029). - Operating Margin:

Tesla would have to surpass most of the auto-makers in the market and ascend to an operating margin of 12% in order to achieve the valuation goal. - Re-investments:

The investments in Solar City, Gigafactory and plant automation needs to pay off at a staggering rate of $2.5 in revenue per dollar of invested capital.

These assumptions would allow Tesla to have a value of $424 per share. The steepness of this climb can be put into perspective by the fact that Tesla would have to deliver the third largest revenues in the auto industry while being one of the most efficient automotive companies in terms of their operating margins and revenue generation per invested capital. As daunting as it may sound, it is still very much possible. We will have to wait and see if the next big disruption occurs in the automotive industry!